🗳 This Week in Governance - April 11: May Require Some Repairs

A weekly resource covering crypto governance, politics, and power.

📣 Key Points

DeFi giant Uniswap under SEC scrutiny

SushiSwap governance continues deterioration

Multichain governance system announced by Wormhole, Tally, and ScopeLift

Voter discovery proposed at ApeCoin DAO

Nouns to consider studying forking mechanics

Voting Activity (L7)

🗳️ 85,760 ballots

👥 16,169 voters

📜 311 proposals

🌐 69 active DAOsQuery more data using the Governance API

DeFi giant Uniswap under SEC scrutiny

Uniswap Labs on April 10th received a Wells notice from the SEC, indicating potential legal action. In a blog post, however, the company expressed their commitment to continuing operations and product development. The company argues that, despite the SEC’s position that tokens are securities, most tokens (like those traded on Uniswap) are not inherently securities but rather digital files capable of storing various types of value, and thus should not be treated as such by regulators. They emphasize that the vast majority of tokens, such as stablecoins and commodities like Ethereum and Bitcoin, are not securities and that tokens on secondary markets like Uniswap do not constitute investment contracts. Precisely how UNI — Uniswap’s governance token, which was launched in 2020 — will be viewed by the SEC is as yet unclear. As UNI is integral to the Uniswap DAO, which was established to give the community decentralized control over many aspects of the development of the protocol, the outcomes of the forthcoming case could have major implications for governance participants.

SushiSwap governance continues deterioration

As described in articles in The Defiant and Decrypt (among others), a swirl of anger was again prompted by a contentious proposal recently posted by Sushi’s Operations Team. The proposal, called “Evolving Sushi - Burū no Shinka,” seeks to transfer significant treasury assets (over $45 million) from the DAO to the centralized Sushi Labs team, in part as a means to improve operations by centralizing control, which would speed up protocol development and address bureaucratic inefficiencies. Naim Boubziz, a critic and former Sushi developer, characterizes the proposal as a "hostile takeover" that sidelines the DAO and manipulates voting power, alleging that the Ops Team boosted their influence through short-term liquidity tactics to win the upcoming vote. Likewise, the wider Sushi community, represented by collective voices like SushiCitizens and individual members like Mountain Goat, largely opposes the move, viewing it as a power grab that undermines the decentralized and community-driven ethos of Sushi’s governance.

Jared Grey, Sushi’s head chef, defends the proposal, stating it is a protective measure against what he claims is an ongoing governance attack (begun months ago) by a group including Humpy, a controversial figure accused of manipulating other decentralized platforms (such as Balancer). There is an ongoing concern about the legitimacy of the proposal vote, especially considering that both the "signal" and "implementation" proposals appeared simultaneously. This is unusual and suggests the core team's confidence in securing a favorable vote. This move has raised suspicions among community members about the transparency and fairness of the governance process.

Multichain governance system announced by Wormhole, Tally, and ScopeLift

MultiGov, a collaborative effort by Wormhole, Tally, and ScopeLift, introduces an industry-first multichain governance system for DAOs on Solana, Ethereum mainnet, and EVM-compatible L2s, with Wormhole DAO being the inaugural adopter. This governance model facilitates active, accessible, and decentralized participation for token holders across various chains by implementing a hub-and-spoke model, allowing proposals and votes to be created and aggregated across supported chains. The system aims to enhance DAO governance by making it more flexible and inclusive, addressing the challenges posed by single-chain governance systems and the rising participation costs on networks like Ethereum.

📚 Reads

Left-Curving DAOs, by LGHT

Next Gen DAOs, by John Palmer

DAOs Beware: Neo-Imperialism Is on the Rise in Crypto-Land, by Martin Schmidt

Two workable mechanics for decentralized governance, from Rune Christensen

Improve Advanced Delegation Voting (Optimism), from Agora

Adding Anonymous Voting Option to Maker Polls, from Open Sky

Aave v3.1 and Aave Origin, from BGD Labs

Should Gnosis Guild steward GnosisDAO Governance? from Gnosis Guild

🎧 Listens

Karma Gap with Mahesh Murthy, on Green Pill

The MakerDAO-Aave Debacle, on 0xResearch

Ronin: The Frontier of Web3 Gaming w/ Jihoz, on StablePod

📜 Highlighted Proposals

ApeCoin: Voter Discovery and Coalitions in ApeCoin DAO

This proposal seeks to enhance ApeCoin DAO's governance by using aggregated data and analysis from DeepDAO to identify barriers to voting, enabling tailored onboarding incentives and programs to increase quality participation and engagement within the community. The initiative aims to optimize governance processes, attract skilled contributors, and protect against governance attacks by analyzing the DAO's voter interests, voting patterns, and internal power coalitions. The proposal requests $25,000 in funding to strengthen the DAO's long-term health through informed decision-making and targeted community outreach. Voting ends on April 17th.

ENS: Enable Self-Funding for the Endowment

This proposal suggests a change to allow the Endowment to finance itself by granting Metagov stewards the ability to withdraw up to 30 ETH monthly for operational expenses, specifically for payments to service providers Karpatkey and Steakhouse. It aims to streamline financial operations by providing a direct allowance for these expenses, thus eliminating the need for continuous funding requests to the DAO. Additionally, it includes a provision for reimbursing the Metagov Safe for 43.54 ETH in service fees already paid for January and February 2024 to apply this financial autonomy retroactively. Voting ended on April 10th with just over 90% voting “for.”

Nouns: Spec and Economic Audit of Alternate Forking Mechanics (incl % Exit)

This proposal outlines a research project by Cryptecon to develop alternative exit strategies for NFTs within the Nouns DAO ecosystem, aiming to address arbitrage that overshadows genuine demand. The project aims to specify and analyze exit schemes that incorporate unique factors of NFTs and minimize arbitrage opportunities, focusing on creating equitable valuation mechanisms. Spanning nine weeks with a budget of $48,000 and one Noun, the project involves economic modeling, game theory, and agent-based simulations to evaluate different exit strategies' impact on auction engagement and ecosystem value. Voting begins on April 12th.

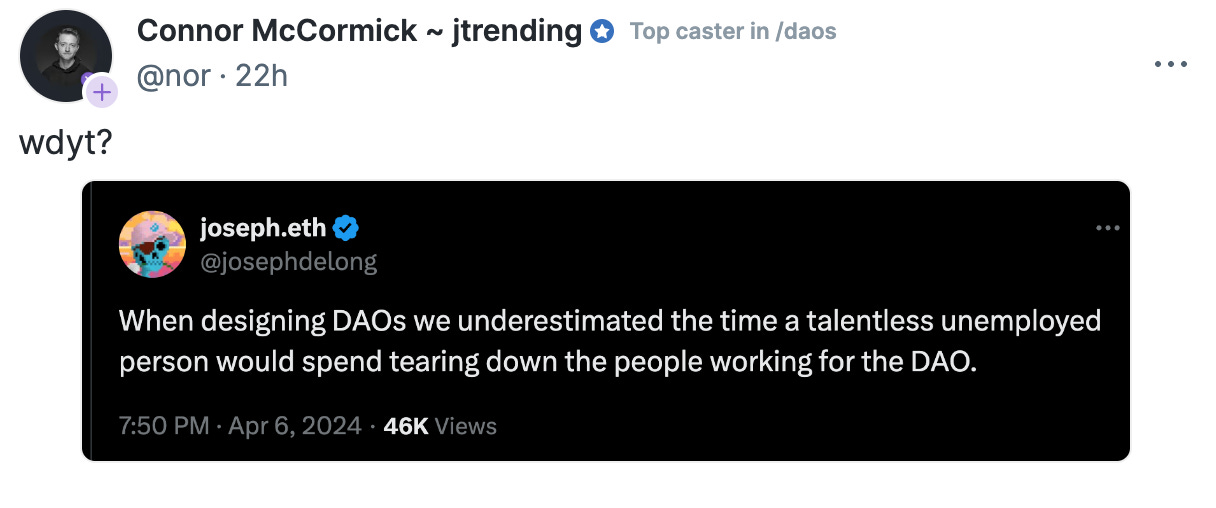

💭 Ecosystem Takes

🎈 Have a Meme

📮 Stay Up to Date

Follow us: Twitter | Discord

Subscribe to: Newsletter | Mirror | Apple | Amazon | Spotify