This Week in DAOs - November 4, 2021

ENS DAO, MakerDAO drama, Aave<>Maker Collab, and Uniswap Proposal #9.

Keep scrolling to get caught up on this week in DAOs.

Reminder:

Are you a governance enthusiast? Aspiring Delegate? Want to find a way to work for a DAO? Learn more about Boardroom’s Governance Scribe program and apply.

📊 This Week’s Stats

Governance Activity - Last 7 Days

🗳️ 3,745 ballots cast on 85 different proposals 🗳️

👥 2,041 unique voters 👥

🌐 28 DAOs with active voters 🌐

✍️ 45 new proposals created this week ✍️

📰 This Week’s News

ENS DAO

Ethereum Name Service (ENS) made a big splash this week when they announced that they will be decentralizing control over “key components of the ENS protocol” with the launch of ENS DAO and the $ENS token.

Three aspects of the new DAO worth noting:

Token Distribution and Utility

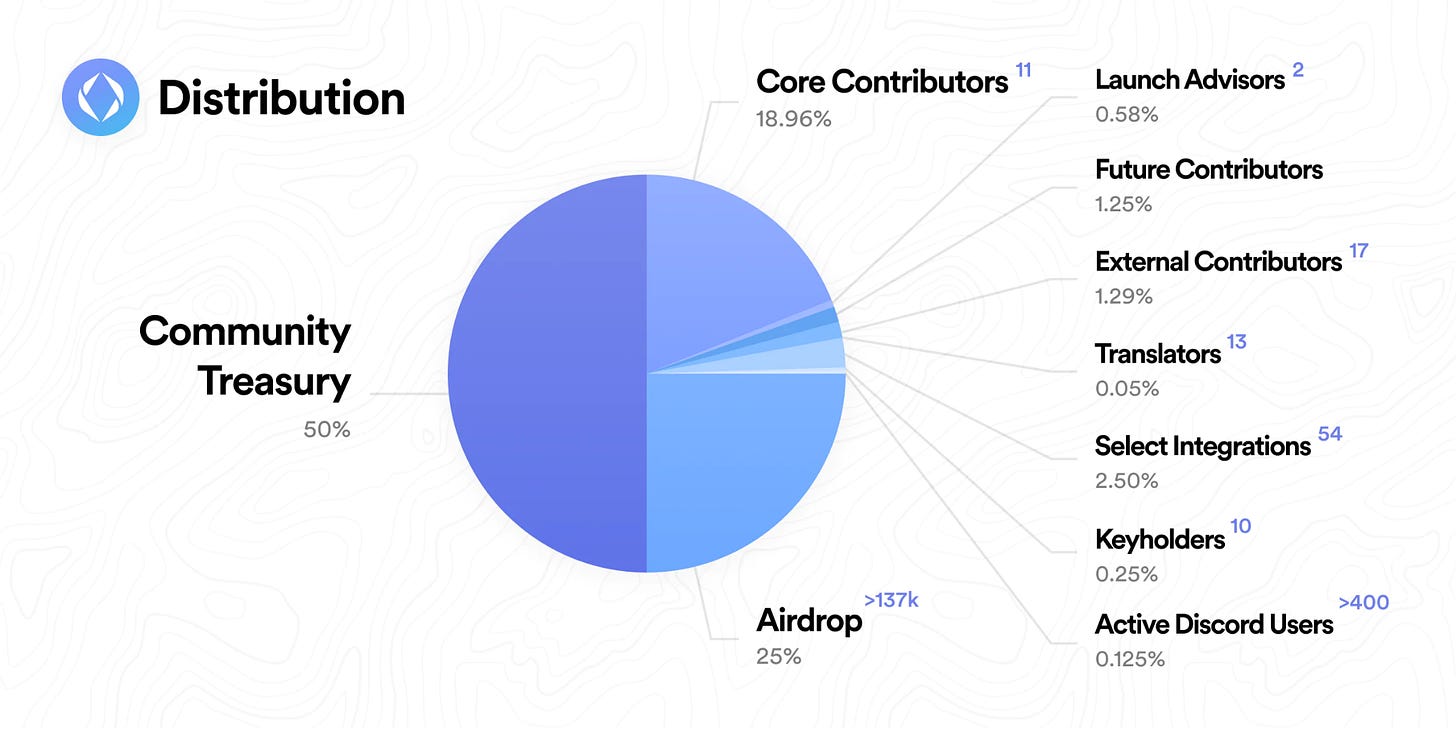

There will be 100 million $ENS tokens minted, with 50% headed to a community-governed treasury and the other split among ENS contributors and users.

Via the ENS DAO, $ENS tokenholders will have control over the ENS Community Treasury. As noted above, this Community Treasury will hold 50% of the $ENS token supply but, crucially, it will also hold the ETH-denominated proceeds of name registrations and renewals. Thus, ENS DAO may end up with one of the largest DAO treasuries in the space.

The first acts of $ENS tokenholders will be to:

Vote on “a proposed ENS Constitution, a set of rules and guidelines for the community” during the first week of the claim process, which starts November 8th.

Vote on “a proposal to formally request from the root key holders the ability to (1) govern protocol parameters, like .ETH pricing, the price oracle, and more [and] (2) control funds from the existing community treasury, as well as receive future revenue.”

After that, ENS DAO will make key decisions about ENS’s handling of various (currently) “non-crypto entities” and their trademarks. This will be something to watch for those interested in how DAOs will interact with “the real world.”

Legal Structure

Speaking of interacting with traditional organizations and frameworks, it is worth noting how ENS is approaching legal structure.

From the above article on their Mirror page, “We have established an organization called The ENS Foundation in the Cayman Islands to legally represent the DAO, e.g. fulfill any tax obligations.”

ENS goes into more detail in their Governance Docs.

Importantly, the DAO will have an explicit role in the Foundation:

The DAO may vote to:

Appoint or remove a director, member, or supervisor.

Prohibit admitting any members in future.

Instruct the directors to wind up the foundation, and specify what charity or other foundation should receive the foundation's assets.

Though not specified directly in the Articles, the DAO may also instruct the directors to take action on behalf of the Foundation - such as signing a contract, engaging a company for a service the DAO requires, or delegating some of the directors' powers to a DAO working group.

Thread to check out if interested in this sort of thing:

Delegation

Following the lead of Gitcoin, ENS DAO is integrating delegation into the token claiming process. Currently there is an open call for delegates:

A running thread of ENS delegate pitches can be viewed on the ENS Discourse here:

MakerDAO Drama

While one big story this week in the DAO world was the launch of a new DAO, another big story was the drama in one of the oldest DAOs: MakerDAO.

Reminder: governance is messy, just look at the United States’ (or any other country’s) politics. If governance isn’t messy then it usually means there isn’t much governance in the first place.

This week, internal politics within MakerDAO was brought out into the sunlight. It all started when Rune Christensen, MakerDAO founder, initiated a governance proposal to remove the current leader of the Real World Assets team, Sébastien Derivaux, from his role. Check it out here:

From Derivaux’s response in the forum, it quickly became evident that this was not something that had been discussed prior to Rune’s post - effectively, Rune was attempting to fire him via governance forum post. From Derivaux:

The ELI5:

I did not decide to leave

I understand @rune don’t trust me as a facilitator

@rune want me out and I understood that he will do whatever it takes to get me out

But I’m working for MKR holders so I want MKR holders to make the call. It’s their DAO.

It seems @rune is quite in control of MakerDAO lately

I don’t want to have a drama that would, in fine, be detrimental to MakerDAO

Based on those data points, I think it makes sense to use an optimistic rollup mechanism (let’s act like it will pass, and revert if not). It’s a first one, so unsure what’s best.

Things started to heat up when Ashleigh Schap, who most recently worked with Uniswap but was involved with the Maker Foundation in the past, posted in the thread and called on the Maker community to vote against Rune’s proposal to preserve decentralization. She also accused Rune of self-dealing and backroom politics.

Rune’s responded addressing Ashleigh’s allegations and provided more detail on the background of his proposal. An excerpt:

I am willing to stay involved for another year to try to put in place the clean money vision and the decentralized workforce framework (I briefly explained it on a recent governance call), and then beyond that I am going to pull out and stop being active in “deep governance” other than passively delegating and potentially using my public platform to promote the project and the important role it can play in mitigating the climate catastrophe.

But if something as simple as offboarding a facilitator has to devolve into absurd drama, then I am just gonna gtfo. There’s no reason why I should have to deal with this kind of madness.

And to be clear, I already stated the entirety of my interests in the beginning of this post. Hopefully this is already obvious but all the claims and accusations Ashleigh made are lies or heavily distorted facts, and obviously the entire narrative is extremely biased and one sided. It’s funny how Ashleigh is accusing me of “going to war”, and then explodes with a tornado of libel because I dared to make a governance proposal.

The TLDR is that, behind the drama of the first public “firing” of a DAO contributor, there is a significant governance issue. Rune believes there is legal risk with how the Real World Asset group and the Centrifuge asset origination model are currently conducted. Keep an eye on this thread. 🍿

AAVE <> MakerDAO

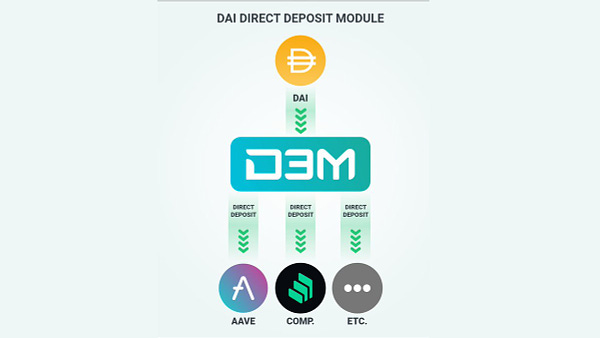

While the governance drama plays out, MakerDAO continues to innovate and iterate on its product. In an example of the DAO-to-DAO business theme we like to highlight in this newsletter, MakerDAO is minting DAI and lending it on Aave, rather than through their normal “collateralized debt position” process.

Uniswap Proposal #9

When a Uniswap governance proposal makes it to the on-chain governance stage, it’s worth highlighting.

Last week, we discussed a proposal making its way through Uniswap governance to add a 1 basis point fee tier to Uniswap V3’s factory contract to compete in the stablecoin swap space.

This proposal passed the Temperature and Consensus check stages is about to officially voted via on-chain governance.