This Week in DAOs - August 5, 2021

The Decentralized Governance Hackathon, Crypto Taxes & DAOs, AAVE v BOND, and KeeperDAO Governance

This week in DAOs includes an upcoming Decentralized Governance Hackathon co-sponsored by Boardroom and others, a major regulatory threat to crypto and DAOs, drama between Aave and Barnbridge, and KeeperDAO’s new governance framework.

Never a dull moment! Keep scrolling to get caught up.

If you want to get involved in Stateless - a community-driven resource covering digital and distributed organizations and their governance - or are interested in learning more about Boardroom, reply here or join our Discord. We’d love to hear from you.

📊 This Week’s Stats

Source: Boardroom Screener

Ecosystem Overview - August 5, 2021:

💰 $8.99 billion in DAO treasuries 💰

🗳️ 208,552 ballots ever 🗳️

👥 57,159 unique voters ever 👥

✍️ 5,994 proposals ever ✍️

Governance Activity - Last 7 Days

🗳️ 4141 ballots cast on 74 different proposals 🗳️

👥 1981 unique voters 👥

🌐 23 projects with active voters 🌐

✍️ 45 new proposals created this week ✍️

📰 This Week’s News

The Decentralized Governance Hackathon

Hopefully, if you’re subscribed to this newsletter, it is safe to assume that you’re a decentralized governance enthusiast.

If that’s the case, we have some exciting news.

Boardroom - along with UMA, Snapshot, Compound, DAOhaus, Gnosis, and OpenLaw - are co-sponsoring a Gitcoin hackathon focused on decentralized governance.

Running from August 17th to September 7th, the Decentralized Governance Hackathon will focus on creating DAOs and scaling decentralized governance, DAO treasury and operations, and crypto-native orgs.

The event will also feature prizes and support for developers to build with tools like Boardroom’s governance data API, UMA’s DAO treasury management financial primitives, Gnosis’ suite of DAO tools, Snapshot’s off-chain voting platform, DAOhaus’ no-code Moloch DAO platform, Compound’s Governor Alpha and Bravo contracts, OpenLaw’s new Tribute DAO framework, and more.

Crypto Taxes and DAOs

Arguably the most substantial news in crypto-land this week is the infrastructure bill that will be voted on some time this week in the United States Senate. One of the proposed “pay-for’s” (i.e. the revenue generators intended to pay for the spending) is targeted at the crypto industry.

The original text of the bill sought to generate $28 billion by applying information reporting requirements to a broad swath of actors in the crypto ecosystem. Specifically, according to Compound’s Jake Chervinsky, “it would expand the Tax Code's definition of ‘broker’ to capture nearly everyone in crypto, including non-custodial actors like miners, forcing them all to KYC users.”

Many of the largest DAOs - such as Uniswap and other DeFi DAOs - would be severely adversely impacted by such a definition of “broker.” Liquidity providers, miners, stakers, DEXes, smart contracts themselves, and so on would - nonsensically - be considered a “broker” if the original language was passed into law.

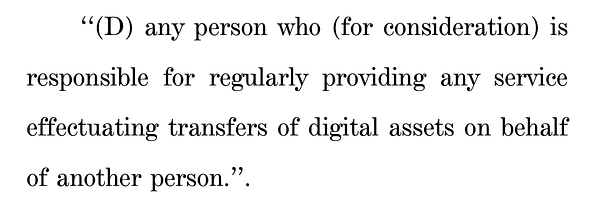

Of course, the crypto industry was up in arms over this provision and there was a change in the text of the bill a few days later. Check out this tweet by Coin Center’s Jerry Brito from Sunday evening which shows the original text and the marginally improved text that replaced it:

The problem, however, is that this new language could still negatively affect groups like miners, stakers, and other actors in the crypto ecosystem. Indeed, DAOs could find themselves on the hook for submitting tax filings to the US government on their members and others, depending on the activities they engage in. This makes no sense, of course, since DAOs and peer-to-peer networks have no capacity to do so given they are decentralized protocols.

The good news is a group of Senators has emerged to offer an amendment to clarify this language and divert the crisis that would ensue if it were to become law.

If you live in the United States, make sure to call your Senators and urge them to vote for the Wyden-Lummis-Toomey amendment:

AAVE<>BOND Governance Battle

Barnbridge is a tokenized risk protocol that enables its users to choose an amount of risk exposure for their investment strategies by purchasing tokens that represent investment and participation in various DeFi products. Barnbridge launched in September 2020 and its native token $BOND has been live for ~7 months.

Barnbridge sought $BOND to be listed as a supported asset on Aave and one of its seed investors, ParaFi Capital, initiated a governance proposal to that end in June. Importantly, BarnBridge accounts for ~$150M to Aave’s total value locked.

Barnbridge’s motivation for wanting to list $BOND as an asset on Aave is to (1) “provide a mechanism through which the DAO could finance growth” since “by adding BOND as collateral, the DAO and individual BOND holders can borrow against their position[s]" and (2) deepen the relationship between the two protocols, which, as mentioned above, already are closely related.

This past week, this proposal was put up for an official governance vote and controversy ensued as VCs flexed their voting power on both sides.

Which elicited some fiery reactions from the community:

As noted in the tweet quoted above, the Nay votes were largely attributed to a handful of wallets controlled by Defiance Capital, which was accused of voting Nay because of interests in a Barnbridge competitor. The founder of the firm responded in the back-and-forth that took place in the replies to the first tweet included above.

The final vote results were 611,350 Nay and 353,600 Yae.

Thus, $BOND will not be added as a supported token on Aave.

This ordeal points to a few aspects of decentralized governance worth highlighting.

First, the sometimes out-sized role of VCs in governance and their arguable conflicts of interest in some governance votes.

Second, the importance of pre-vote consensus building. The Barnbridge team noted that Defiance hadn’t expressed any of their concerns during the proposal stage on Aave’s governance forum. On the other hand, Aave leaders suggested that Barnbridge should’ve done more to gauge the temperature of the community and give notice of the official on-chain vote:

These types of episodes are full of lessons for the DAO community as we learn from each other’s experiences with decentralized governance. However, we should remember to keep the big picture in view:

KeeperDAO Governance

KeeperDAO - an “onchain liquidity underwriter for DeFi” - allows individuals (called “Keepers”) to draw from a shared liquidity pool to take advantage of on-chain profit opportunities such as “liquidating a position in Compound or dYdX, taking over a Maker CDP, rebalancing a SET basket, or taking advantage of arbitrage between Kyber and Uniswap.” For more info on how it works, check out their FAQ page.

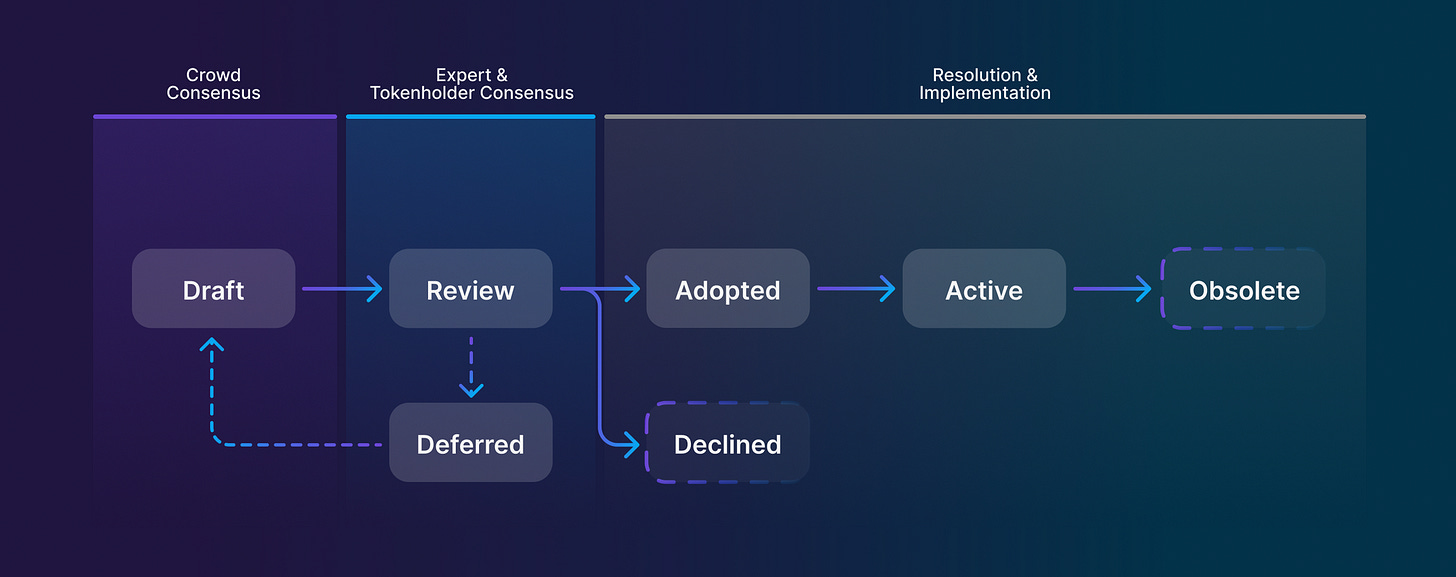

This week, KeeperDAO rolled out their governance framework that will be used to manage the Keeper ecosystem.

The above-linked blog is a great read.

It dives deep into the theoretical underpinnings of what Keeper considered when designing its governance, including overcoming the tragedy of the commons, the upsides and downsides of token-weighted voting, the forking threat, meritocracy, and more.

It also outlines KeeperDAO’s governance design.

We introduce a minimalistic three-mode governance designed so that when consensus is high, efficiency is high, and when consensus is low, efficiency is low. This allows our governance to be as efficient as possible, while maintaining a stable level of legitimacy.

KeeperDAO seems to have put a lot of effort into thinking through their governance. What do you think of their design? Reply here or join us on the Boardroom Discord to talk about it.

Stateless by Boardroom is a community-driven resource covering digital and distributed organizations and their governance. If you’re interested in contributing to Stateless, reply here or reach out to us on the Boardroom Discord.