Welcome to DGR’s GovBytes! This series features snack sized snippets providing quick & digestible explanations, analysis, & breakdowns of crypto governance topics

It seems like just yesterday that we were reading that community governance was live on Compound Finance. From April 16th onward, all changes to the protocol would originate from COMP holders.

Yesterday, on April 27th, Dharma announced their submission of an upgrade proposal, becoming the first integrated application to propose an upgrade to Compound Finance 🤩💸

This just hours after the first-ever governance proposal had been created by the Compound team to add $USDT as a supported asset:

But, before we dive into all of this, how exactly does Compound Governance work, and where do these proposals go from here?

A Move Toward Decentralization

Compound had announced the launch of this new governance token with the aim of developing a mechanism enabling community-led governance:

At Compound, our goal is to create financial infrastructure that applications and developers can rely on, forever. To get there, we intend to fully decentralize the Compound protocol — removing the largest single point of failure (our team), and creating an indestructible, open protocol that can evolve in entirely new ways.

Today, we’re proud to introduce a governance system that will replace the Compound protocol’s administrator with community governance — allowing you to suggest, debate, and implement changes to Compound — without relying on, or requiring, our team whatsoever. Compound Governance by Robert Leshner

The COMP Token

By issuing a token solely for the purposes of governance with a staggered rollout and distribution strategy, the team can attempt to create the most equitable and beneficial distribution of the token in comparison to others that allow for both staking and governance capabilities:

Liquid Democracy

The trend towards representative governance systems is becoming clear: delegation should play a central role in encouraging the participation of stakeholders.

Possessing COMP and participating in Compound governance are not the same; COMP token-holders can

delegatevoting authority to any address; their own, a hot wallet (while COMP sits in cold storage), a DAO, or your address.

This is not a new idea in the ecosystem by any means: the MakerDAO community has been discussing this to counter low turnout, voter apathy, and power capture by large tokenholders. Tezos, as well as many PoS blockchains, have a variety of different governance delegation mechanisms. This trend recognizes that so-called “protocol politicians”, or knowledgeable stakeholders that may also have a vested interest in the success of the network, and related to that, its directions will have a higher incentive to actually participate in decision making and create a more robust and inclusive decision-making system.

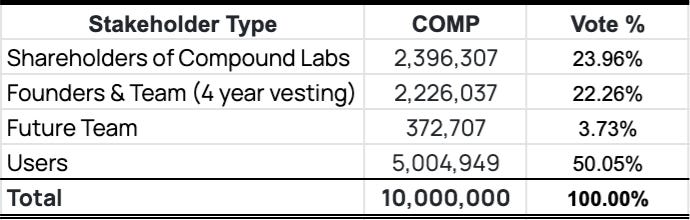

COMP Distribution

A collection of Compound’s most important stakeholders currently share the ability to participate in the protocol’s governance process:

🗳️ Live Proposals

So, we finally arrive at the live proposals. In the span of just days, we’ve seen strong support and commentary on both:

USDT Support Proposal

This proposal adds Tether as a supported asset, with no collateral factor or reserve factor, and updates the Compound price feed to conservatively peg Tether to $1. By using a peg, weakness in the underlying asset won’t change collateral requirements for users borrowing Tether.

⏰ Ends in: 1 day, 12 hrs

Dharma’s Proposal

Update DAI Interest Rate Model to Better Accommodate Zero Stability Fee

In short, the Dharma team highlights that when the DAI interest rate model was developed and deployed, the community, including the Compound team, did not anticipate the Stability Fee (SF) and Dai Savings Rate (DSR) in MakerDAO's Multi-Collateral Dai (MCD) system to be set to zero for a prolonged period of time. As a result, the current Dai interest rate model in Compound does not provide a good user experience to capital suppliers when the SF and/or DSR are zero.

They propose a new interest rate model for Dai that can provide a better user experience to capital suppliers with a minimal impact to borrowers. Read all about the proposal here.

⏰ Ends in: 2 days, 05hrs

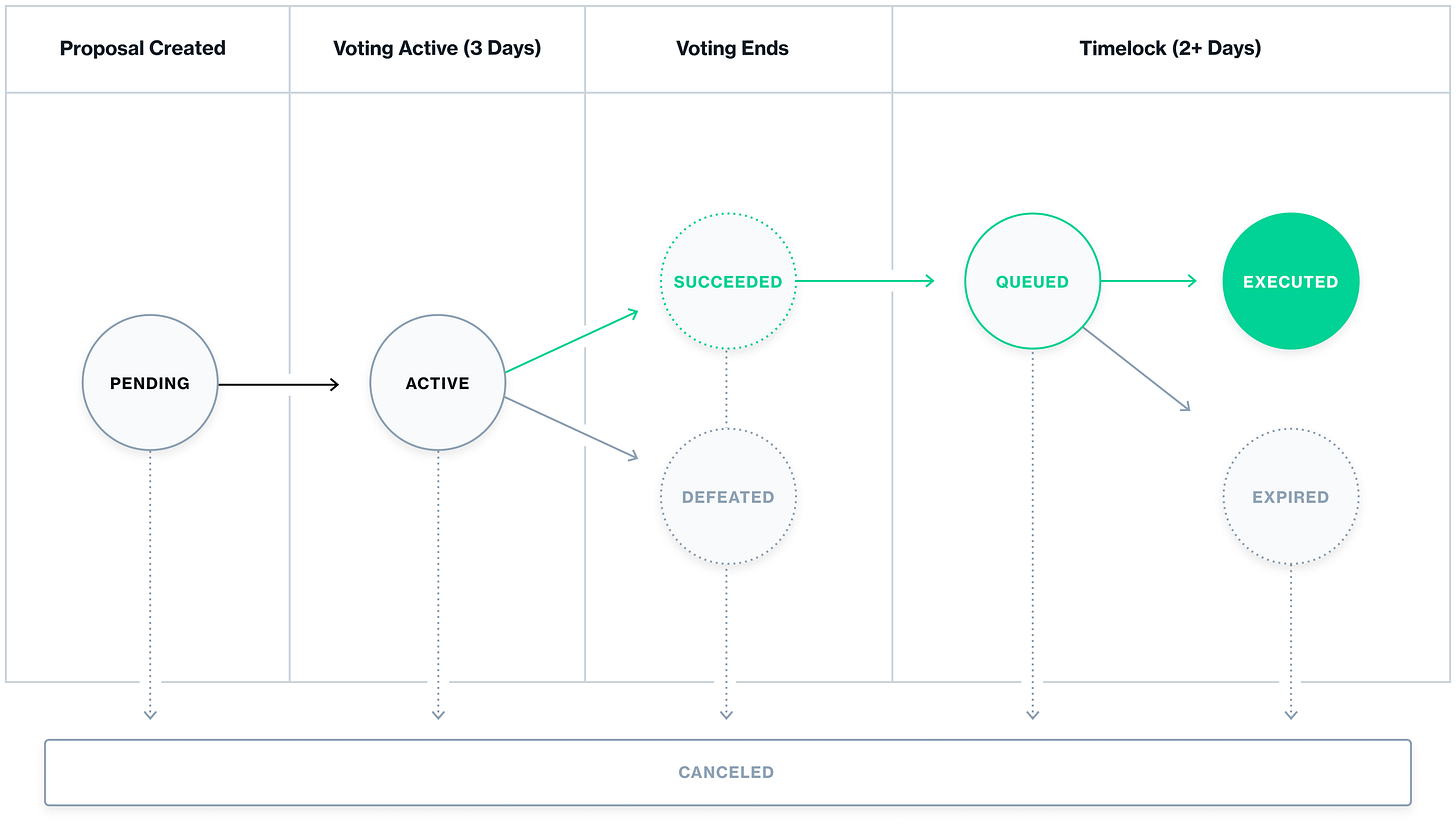

The Governance Framework

As soon as the voting periods ends for both these proposals, they will enter a timelock queue if they achieve a majority vote and clear the 4% quorum. The following chart recaps the process from start to finish:

Phase 1

Any stakeholder with at least 1% of COMP delegated to their address can propose a governance action - this minimum floor protects against spam. A proposer cannot create another proposal if they have an active or pending one.

The creators of the current live proposals cleared this hurdle:

Phase 2: Voting Period

The three day voting period allows any address with voting power (that holds COMP or has been delegated COMP) to vote “For” or “Against” a proposal.

As of today, neither proposal has cleared the 4% or 400,000 COMP token quorum.

Phase 3: Timelock

If a majority of votes approve the proposal, it enters a timelock queue and then may be implemented after 48 hours. We’ll be sure to keep close tabs on the progress of both proposals - you’ll be able to read all about it in the Distributed Governance Report issue coming out in May!

How Do I Participate?

As governance begins, we hope that this initial proposal can serve as a template and inspiration for the community to develop their own proposals, upgrades, and ideas. Already, members of the community have set up a forum to discuss proposals, and submitted pull requests to the Compound code repository.

If you have any questions, ideas, or issues, join us in Discord — we’d love to hear from you. From all of us at Compound, 📈. - Robert Leshner

What is Compound?

Compound is a decentralized money market protocol for borrowing and lending assets. It’s an Ethereum protocol that establishes these markets with algorithmically set interest rates where users and dApps are able to earn interest on ETH and other tokens, as well as borrow Ether and tokens to invest, use, or short-sell. The protocol was founded by Robert Leshner and Geoffrey Hayes. Learn more at compound.finance.

The Distributed Governance Report is a monthly newsletter aiming to decipher the complex world of distributed network governance, politics, and power. Stay tuned for the next one coming in May by subscribing now, and never miss an issue: