Readers of this newsletter may recall that in early June of this year, the Arbitrum DAO passed a proposal to “catalyze gaming ecosystem growth on Arbitrum.” This launched the Gaming Catalyst Program (GCP), funded with 225 million ARB tokens to spend over three years. The GCP, the proposal argued, will increase game developer adoption of Arbitrum technologies like Orbit and Stylus, develop the necessary infrastructure, and facilitate the launch of high-quality games, positioning Arbitrum as a leading platform for on-chain gaming. Oversight mechanisms, including a council and regular transparency reports, are to ensure continuing alignment with DAO values. One of the proposal’s lead authors was Karel Vuong, co-founder of Treasure, the decentralized gaming ecosystem.

Moving Treasure

Although the proposal encountered some significant resistance (partly due to its enormous price tag), in the end, 76.27% of token holders voted “for.” The most prominent delegate expressing support was Treasure, which commanded 18m+ ARB. (Treasure had also received an airdrop of 8m ARB.) But Treasure recently announced that it will be launching the Treasure L2 on ZKsync. This is news for several reasons, not least because Treasure had previously preferred Arbitrum Orbit.

Bring it Back

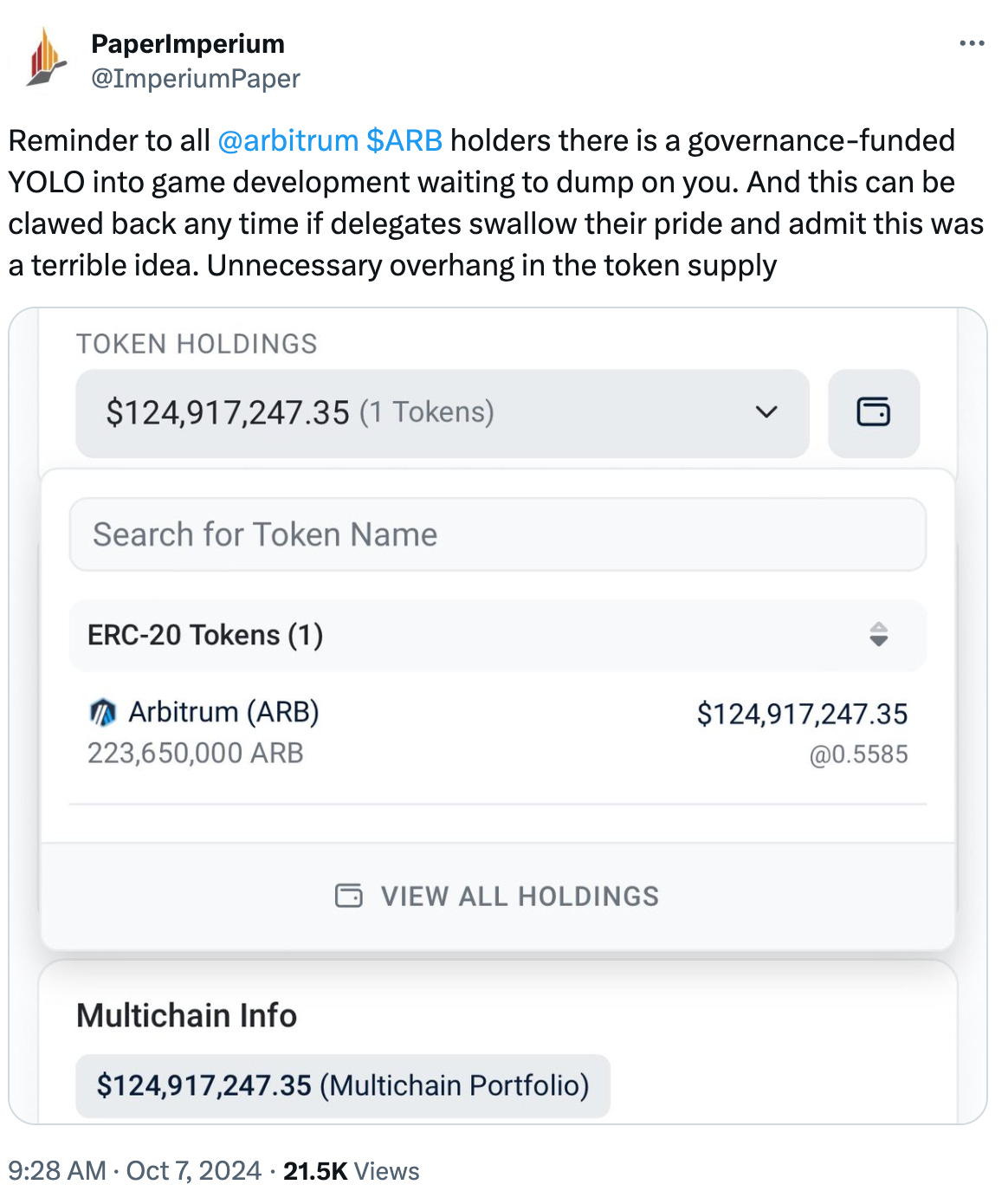

This development prompted the following tweet from PaperImperium of GFXlabs, who pointed to the large holdings of the GCP wallet:

He continues later in the thread: “It’s nine figures of dilution for a non-core business where Arbitrum has no competitive advantage and governance is not well suited to supervise it.”

This post garnered several supportive comments from like-minded Arbitrum DAO members, who wondered whether other delegates would have enough support to “claw back” the funds to the DAO’s treasury. However, Offchain Labs’ A.J. Warner disagreed with the OP on several points. He defended the GCP, emphasizing that investing in gaming is crucial for Arbitrum's growth and competitiveness. He highlighted Arbitrum's technological advantages in gaming and expressed confidence in the governance structures that ensure the proper use of funds.

ImmutableLawyer, initially a skeptic of the GCP but now a supporter, added that the DAO needs to commit to its decisions, especially ones that will take years to play out. Warner expands on the idea:

In response, PaperImperium observed that there’s been a striking lack of activity and communication from the GCP: “We’re talking about the same GCP that’s not produced many meeting summaries, any transparency reports, or the promised vote confirmation of the appointed members of the GCP’s council/board? Missed oversight deadlines at this early stage not good signs for an LP.” The “GCP Update Thread” hasn’t seen an update in almost a month — and that was to notify the DAO that someone was stepping down from the GCP Council.

Governance (In)action

Skeptics of the Gaming Catalyst Program now wonder whether they can gather enough support to vote to bring the GCP funds back to the DAO treasury. It’s unclear whether enough support exists or how much the community pays attention. Keep an eye on the Arbitrum forum for posts on the topic.

In any event, this appears to be a textbook test of DAO governance: Can substantive, public discussion on this topic be had? Are there enough voices — not to say active participants — in the DAO to make that discussion meaningful? Can such a discussion lead to effective decisions? And how much will large bag-holders control the outcome behind the scenes?

🔍 Key Developments Across the Ecosystem

1. Arbitrum DAO Procurement Committee: Phase II Proposal

The Arbitrum DAO Procurement Committee (ADPC) has submitted a proposal to extend its work into Phase II for an additional 6-month period. Phase I successfully established a comprehensive procurement framework, laying the groundwork for improved operational efficiency within the DAO. Phase II will focus on two key verticals: procurement of RPC providers to streamline infrastructure costs for projects on Arbitrum and procurement of event providers in line with the DAO’s 2025 event strategy. Additionally, the ADPC will continue managing the Subsidy Fund for Security Services and propose an Operational Expense (OpEx) budget to facilitate the DAO’s ability to engage pre-approved service providers without requiring lengthy governance processes.

The budget for Phase II amounts to 954,608 ARB, based on a time-weighted average ARB price, with an added buffer to protect against price fluctuations. Unused ARB will be returned to the DAO treasury. The ADPC aims to build on the success of Phase I, with increased transparency, community engagement, and alignment with the DAO's future structure, such as the potential establishment of an OpCo. Read more

2. Lido Proposes Community Staking Module

Lido DAO has introduced a proposal for the Community Staking Module (CSM), aimed at decentralizing staking by enabling smaller operators to participate in the network. The CSM seeks to empower community members by allowing them to stake ETH with operators outside the more extensive, established validators. The goal is to promote decentralization while maintaining the security and efficiency of Lido’s staking infrastructure. The discussions around this proposal have raised key points on balancing security with decentralization, with community members exploring the challenges and potential risks of onboarding smaller operators. Some participants have expressed concerns about ensuring robust operator selection processes, while others emphasize the importance of fostering decentralization to ensure long-term network health. Proposal

The proposal has sparked a broader conversation about how Lido can continue to lead in the staking ecosystem while addressing community concerns around centralization. As this initiative progresses, additional feedback from stakeholders is expected to refine the CSM structure further. Read more

3. Aave Temp Check: Onboarding EigenLayer to Aave v3 Ethereum

Aave is conducting a temperature check on the proposal to onboard EigenLayer to Aave v3 on Ethereum. The EigenLayer protocol provides re-staking services, allowing users to stake their assets across multiple DeFi platforms, potentially enhancing liquidity and efficiency. By integrating EigenLayer, Aave could tap into re-staked assets to improve capital efficiency and expand its user base…

🚨 To keep reading, sign up below. Subscribe to Boardroom for real-time updates, all conveniently organized in one place. 📥✨